The Banking Secret We Never Learn As

Kids

One of my first financial lessons as a kid was the discipline

of saving money. I remember my mom taking

me to the bank with a passport savings book and she would always show me my deposits,

tell me money was safe and growing every year.

Back in those days (early-1980’s) interest rates were averaging

6 to 8% which really had an impact on my savings. The good old days, right?

I loved seeing my money grow and so the discipline of saving

stuck and for that I am forever grateful to my parents. But what also stuck was the idea that banks

are the place park money for future use.

My mom didn’t know of any other alternative so naturally neither would

I.

These days I know better… and I choose better for my

kids. I have 3 kids and each of them having

their own Infinite Banking designed Whole Life policy because I don’t want them

to ever rely on banks. Instead I’m

teaching them to profit the same way bankers do with their own banking system

they’ll eventually own and control.

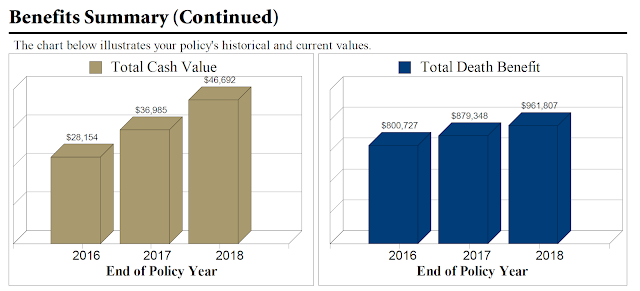

Rather than a passport savings account, I show my kids their

annual statement which includes information like the picture above. In fact, that’s from my daughter’s latest

statement ending last year.

What’s really cool is that the combined wealth my kids have

already accumulated has helped them fund a stake in an apartment complex where projected investor returns will

average 8.8% cash-on-cash and 19.1% annualized return on investment (ROI) over

a proposed 7-year hold period.

Meanwhile,

the cash values they’ve accumulated will still be growing in their policies… money

working in two places at one time which I call Dual Compounding.

Pretty

cool, right? And did you notice the

death benefit is just coming along for the ride, too? I’ve not only set up my kids for financial

success when they come of age but I’ve also created a legacy that will impact

multiple generations of my family tree.

What

will you choose for yourself and your kids?

Click the photo above and I’ll show you how to get started in 3 simple

and easy steps.

Cheers,

John

Montoya

IBC® Authorized

Practitioner