Tuesday, September 27, 2011

Trader on BBC says Eurozone Market will Crash

When you've been lied to for a very long time, it is difficult to accept truth.

Friday, September 23, 2011

It's Over - A Realtor Finally Speaks The Truth

Here's a realtor who actually gets it. Listen at 6:18 where he talks about 401ks and IRAs. As he points out, it's a fraud.

I recommend reading The Pirates From Manhattan by Barry Dyke if you want to dive into how exactly Wall Street is ripping investors off.

Gold And Silver Price Drop=I'm Buying!!! - Mike Dilliard

The following is an email I received as a member of the Elevation Group and was penned by Mike Dilliard. Take note, nothing has changed. Good info. Enjoy.

So why are metals dropping?

Well he dominant trend in the market right now is deflation. Credit markets are locking up once again, things are slowing down, and when that happens, everything gets sold as institutions move into cash or bonds.

This is exactly what happened in 2008.

As the selling kicks in, large sell-stops are triggered which initiates even more selling, triggering more sell-stops, and the whole thing just falls like dominos until the price gets so low that buy orders are triggered and the selling slows.

Welcome to the world of algorithmic trading. It’s always a wild ride…

In addition, the Dollar is the prettiest horse in the glue factory at the moment.

The Swiss screwed the Franc, and the Euro is falling apart, so the only real currency option left is the Dollar.

Even though it too is doomed, it will be the last fiat currency standing. Once it starts to falter, gold and silver go parabolic and the greatest wealth transfer in history will take place.

As I’ve been saying since Day 1, deflation is what should/needs to happen, but the banks are going to do everything they can to try and prevent it.

Their primary solution has always been to simply print more money, which is what the Fed has been doing since 2008 with QE1, QE2, and now “Operation Twist” this week.

The worse things get, the more they will print. They don’t have a choice. And this will eventually lead to a hyperinflationary depression at some point over the next 2-5 years.

The destruction of an Empire’s financial system (which is what we’re watching), isn’t going to be a smooth ride. We’re going to see fluctuations like this one often, but the overall, long-term trend for precious metals is up, and down for the Dollar…

None-the-less, when I started investing in the metals market almost four years ago, I was always emotionally involved in the price on a daily basis.

But after going through so many ups-and-downs, I finally realized that the short term is irrelevant. All I care about is the long-term trend, which is infinitely higher for precious metals.

Back when I was buying in 2008, I saw the price of silver drop by 60%. If that happened today, we’d see prices drop from the $49 high, down to $19.60.

Will that happen? I doubt it, but damn I hope so… Nothing would make me more excited than the opportunity to buy silver for less that $25/ounce again!!!

So if you’re panicking and wondering if you should sell when big price drops take place, it means two things…

1: You don’t understand the fundamental reasons you made the investment to begin with.

2: You’re making investment decisions based on emotion, which is the single best way to end up broke.

When I see declines like this one, I get EXCITED because they give me an opportunity to buy more of my favorite investment at a discount…

And that’s exactly what I did about 10 minutes ago, making significant purchases of both gold and silver.

Ask yourself…

Have any of the fundamental reasons a person would buy gold and silver changed recently?

Is the US debt level is mathematically impossible to pay off? YES.

The US has chosen to print more and more currency out of thin air in order to pay its current debts? YES.

Has very single fiat currency in history like the US Dollar has been destroyed? YES.

Has every fiat currency had an average lifespan of 30-40 years? YES.

Has the US has created more fake currency out of thin air in the past 36 months, than it has in the last 85 years? YES.

Have nations like China and Russia have started moving away from the Dollar in trade, which signals the end of its role as the global reserve currency? YES.

Has silver has been manipulated by the Fed and its partner banks such as JP Morgan for decades? YES.

Is the EURO about to implode? YES.

Have the major US and EURO banks just been downgraded by the rating agencies this month? YES.

The bottom line is that things are not getting better, they are getting MUCH WORSE, just as we’ve always said they would.

All of the reasons to buy gold and silver are stronger today than they’ve ever been, and RIGHT NOW the market’s giving me a chance to buy more, for less money.

So a big “thank you” to all of the sellers this week… I’ll gladly take those shiny coins off your hands :)

The bottom line is that you need to know why you’re in precious metals, and if you’re in them, then stay in them for the long, profitable run ahead of us and forget about the day-to-day moves.

Gold has declined less than 15% from its top at $1900.30, which means it is long overdue for a correction, however I know that most recent buyers of gold --and by "recent" I mean since 2008-- most of these might panic and sell. This is always to be expected in a bull market and is completely normal.

Don't make that mistake.

New buyers probably don’t even realize that silver is STILL up around 60% since the beginning for 2011, and around this time last year, it was only $17 an ounce!

So if you’re like me, you’ll start to get excited when the price drops, and use those moments as opportunities to pick up your investments at a discount…

I’ve just placed an order for both metals this morning, and I’m holding 50% of my available funds until next week incase they drop even more…

Then, I'm just going to sit tight and be right as I have been since 2008.

Sincerely,

Mike Dillard

So why are metals dropping?

Well he dominant trend in the market right now is deflation. Credit markets are locking up once again, things are slowing down, and when that happens, everything gets sold as institutions move into cash or bonds.

This is exactly what happened in 2008.

As the selling kicks in, large sell-stops are triggered which initiates even more selling, triggering more sell-stops, and the whole thing just falls like dominos until the price gets so low that buy orders are triggered and the selling slows.

Welcome to the world of algorithmic trading. It’s always a wild ride…

In addition, the Dollar is the prettiest horse in the glue factory at the moment.

The Swiss screwed the Franc, and the Euro is falling apart, so the only real currency option left is the Dollar.

Even though it too is doomed, it will be the last fiat currency standing. Once it starts to falter, gold and silver go parabolic and the greatest wealth transfer in history will take place.

As I’ve been saying since Day 1, deflation is what should/needs to happen, but the banks are going to do everything they can to try and prevent it.

Their primary solution has always been to simply print more money, which is what the Fed has been doing since 2008 with QE1, QE2, and now “Operation Twist” this week.

The worse things get, the more they will print. They don’t have a choice. And this will eventually lead to a hyperinflationary depression at some point over the next 2-5 years.

The destruction of an Empire’s financial system (which is what we’re watching), isn’t going to be a smooth ride. We’re going to see fluctuations like this one often, but the overall, long-term trend for precious metals is up, and down for the Dollar…

None-the-less, when I started investing in the metals market almost four years ago, I was always emotionally involved in the price on a daily basis.

But after going through so many ups-and-downs, I finally realized that the short term is irrelevant. All I care about is the long-term trend, which is infinitely higher for precious metals.

Back when I was buying in 2008, I saw the price of silver drop by 60%. If that happened today, we’d see prices drop from the $49 high, down to $19.60.

Will that happen? I doubt it, but damn I hope so… Nothing would make me more excited than the opportunity to buy silver for less that $25/ounce again!!!

So if you’re panicking and wondering if you should sell when big price drops take place, it means two things…

1: You don’t understand the fundamental reasons you made the investment to begin with.

2: You’re making investment decisions based on emotion, which is the single best way to end up broke.

When I see declines like this one, I get EXCITED because they give me an opportunity to buy more of my favorite investment at a discount…

And that’s exactly what I did about 10 minutes ago, making significant purchases of both gold and silver.

Ask yourself…

Have any of the fundamental reasons a person would buy gold and silver changed recently?

Is the US debt level is mathematically impossible to pay off? YES.

The US has chosen to print more and more currency out of thin air in order to pay its current debts? YES.

Has very single fiat currency in history like the US Dollar has been destroyed? YES.

Has every fiat currency had an average lifespan of 30-40 years? YES.

Has the US has created more fake currency out of thin air in the past 36 months, than it has in the last 85 years? YES.

Have nations like China and Russia have started moving away from the Dollar in trade, which signals the end of its role as the global reserve currency? YES.

Has silver has been manipulated by the Fed and its partner banks such as JP Morgan for decades? YES.

Is the EURO about to implode? YES.

Have the major US and EURO banks just been downgraded by the rating agencies this month? YES.

The bottom line is that things are not getting better, they are getting MUCH WORSE, just as we’ve always said they would.

All of the reasons to buy gold and silver are stronger today than they’ve ever been, and RIGHT NOW the market’s giving me a chance to buy more, for less money.

So a big “thank you” to all of the sellers this week… I’ll gladly take those shiny coins off your hands :)

The bottom line is that you need to know why you’re in precious metals, and if you’re in them, then stay in them for the long, profitable run ahead of us and forget about the day-to-day moves.

Gold has declined less than 15% from its top at $1900.30, which means it is long overdue for a correction, however I know that most recent buyers of gold --and by "recent" I mean since 2008-- most of these might panic and sell. This is always to be expected in a bull market and is completely normal.

Don't make that mistake.

New buyers probably don’t even realize that silver is STILL up around 60% since the beginning for 2011, and around this time last year, it was only $17 an ounce!

So if you’re like me, you’ll start to get excited when the price drops, and use those moments as opportunities to pick up your investments at a discount…

I’ve just placed an order for both metals this morning, and I’m holding 50% of my available funds until next week incase they drop even more…

Then, I'm just going to sit tight and be right as I have been since 2008.

Sincerely,

Mike Dillard

Ron Paul Highlights in 9/22/2011 Presidential Debate

It's amazing to me how sincere and logical Ron Paul comes across compared to other candidates. Every answer is well thought out and strikes a chord because it resonates with honesty. There are no gimmicks with Ron Paul. He cannot be bought and his libertarian views are catching on with a wider audience who listen to his arguments.

His ideas, once ridiculed by the media and Republican party, are now mainstream and parroted by each of GOP presidential candidates. As his influence and popularity grows, so will hope that we can turn this country around.

Freedom and liberty can and will prevail again in this country.

Listen at 6:17 to hear Ron Paul's thoughts on what causes are recessions and bubbles. He gets it. Do you?

Labels:

GOP,

libertarian,

presidential debate,

republican party,

Ron Paul

Thursday, September 22, 2011

Austrian Economics: Why It Matters

Austrian economics is oldest continuously existing economic thought in the world but it has been neglected for the past 100 years. It is now making a comeback because Austrian economics have predicted every downturn in the economy.

If you want to understand why the Keynesian model doesn't work, study Austrian economics.

"The Austrian economists have a track record only the Keynesian economists can dream of." - Thomas Woods

Labels:

Austrian Economics,

Keynesian,

Keynesian Economics,

Thomas,

Woods

Wednesday, September 21, 2011

Bill Still: There is No Gold at Fort Knox

Which part of his argument do you agree with?

Commercial banks are responsible for 90% of inflation because of the fractional reserve banking system. If this is true, than what Still says about controlling the money supply has merit. A gold standard with fractional reserve banking is only a slight improvement over what we have. It seems to me we need to end the criminal banking cartel that is the Federal Reserve and also the fractional reserve banking system.

Why not have gold and silver compete with interest free money? Let the free market decide. It least both options are based on sound money principles.

Tuesday, September 20, 2011

Thomas Jefferson

Words of wisdom we seem to have forgotten from one of our brightest forefathers.

"When we get piled upon one another in large cities, as in Europe, we shall become as corrupt as Europe ." -- Thomas Jefferson

"The democracy will cease to exist when you take away from those who are willing to work and give to those who would not."

-- Thomas Jefferson

"It is incumbent on every generation to pay its own debts as it goes. A principle which if acted on would save one-half the wars of the world."

-- Thomas Jefferson

"I predict future happiness for Americans if they can prevent the government from wasting the labors of the people under the pretense of taking care of them." -- Thomas Jefferson

"My reading of history convinces me that most bad government results from too much government." -- Thomas Jefferson

"No free man shall ever be debarred the use of arms." -- Thomas Jefferson

"The strongest reason for the people to retain the right to keep and bear arms is, as a last resort, to protect themselves against tyranny in government."

-- Thomas Jefferson

"To compel a man to subsidize with his taxes the propagation of ideas which he disbelieves and abhors is sinful and tyrannical."

-- Thomas Jefferson

Thomas Jefferson said in 1802:

"I believe that banking institutions are more dangerous to our liberties than standing armies.

If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around the banks will deprive the people of all property - until their children wake-up homeless on the continent their fathers conquered."

John F. Kennedy held a dinner in the white House for a group of the brightest minds in the nation at that time. He made this statement: "This is perhaps the assembly of the most intelligence ever to gather at one time in the White House with the exception of when Thomas Jefferson dined alone."

Thomas Jefferson was a very remarkable man who started learning very early in life and never stopped.

At 5, began studying under his cousin's tutor.

At 9, studied Latin, Greek and French.

At 14, studied classical literature and additional languages.

At 16, entered the College of William and Mary.

At 19, studied Law for 5 years starting under George Wythe.

At 23, started his own law practice.

At 25, was elected to the Virginia House of Burgesses.

At 31, wrote the widely circulated "Summary View of the Rights of British America” and retired from his law practice.

At 32, was a Delegate to the Second Continental Congress.

At 33, wrote the Declaration of Independence.

At 33, took three years to revise Virginia?s legal code and wrote a Public Education bill and a statute for Religious Freedom.

At 36, was elected the second Governor of Virginia succeeding Patrick Henry.

At 40, served in Congress for two years.

At 41, was the American minister to France and negotiated commercial treaties with European nations along with Ben Franklin and John Adams.

At 46, served as the first Secretary of State under George Washington.

At 53, served as Vice President and was elected president of the American Philosophical Society.

At 55, drafted the Kentucky Resolutions and became the active head of Republican Party..

At 57, was elected the third president of the United States .

At 60, obtained the Louisiana Purchase doubling the nation's size.

At 61, was elected to a second term as President.

At 65, retired to Monticello .

At 80, helped President Monroe shape the Monroe Doctrine.

At 81, almost single-handedly created the University of Virginia and served as its first president.

At 83, died on the 50th anniversary of the Signing of the Declaration of Independence along with John Adams

Thomas Jefferson knew because he himself studied the previous failed attempts at government. He understood actual history, the nature of God, his laws and the nature of man. That happens to be way more than what most understand today. Jefferson really knew his stuff.

"When we get piled upon one another in large cities, as in Europe, we shall become as corrupt as Europe ." -- Thomas Jefferson

"The democracy will cease to exist when you take away from those who are willing to work and give to those who would not."

-- Thomas Jefferson

"It is incumbent on every generation to pay its own debts as it goes. A principle which if acted on would save one-half the wars of the world."

-- Thomas Jefferson

"I predict future happiness for Americans if they can prevent the government from wasting the labors of the people under the pretense of taking care of them." -- Thomas Jefferson

"My reading of history convinces me that most bad government results from too much government." -- Thomas Jefferson

"No free man shall ever be debarred the use of arms." -- Thomas Jefferson

"The strongest reason for the people to retain the right to keep and bear arms is, as a last resort, to protect themselves against tyranny in government."

-- Thomas Jefferson

"To compel a man to subsidize with his taxes the propagation of ideas which he disbelieves and abhors is sinful and tyrannical."

-- Thomas Jefferson

Thomas Jefferson said in 1802:

"I believe that banking institutions are more dangerous to our liberties than standing armies.

If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around the banks will deprive the people of all property - until their children wake-up homeless on the continent their fathers conquered."

John F. Kennedy held a dinner in the white House for a group of the brightest minds in the nation at that time. He made this statement: "This is perhaps the assembly of the most intelligence ever to gather at one time in the White House with the exception of when Thomas Jefferson dined alone."

Thomas Jefferson was a very remarkable man who started learning very early in life and never stopped.

At 5, began studying under his cousin's tutor.

At 9, studied Latin, Greek and French.

At 14, studied classical literature and additional languages.

At 16, entered the College of William and Mary.

At 19, studied Law for 5 years starting under George Wythe.

At 23, started his own law practice.

At 25, was elected to the Virginia House of Burgesses.

At 31, wrote the widely circulated "Summary View of the Rights of British America” and retired from his law practice.

At 32, was a Delegate to the Second Continental Congress.

At 33, wrote the Declaration of Independence.

At 33, took three years to revise Virginia?s legal code and wrote a Public Education bill and a statute for Religious Freedom.

At 36, was elected the second Governor of Virginia succeeding Patrick Henry.

At 40, served in Congress for two years.

At 41, was the American minister to France and negotiated commercial treaties with European nations along with Ben Franklin and John Adams.

At 46, served as the first Secretary of State under George Washington.

At 53, served as Vice President and was elected president of the American Philosophical Society.

At 55, drafted the Kentucky Resolutions and became the active head of Republican Party..

At 57, was elected the third president of the United States .

At 60, obtained the Louisiana Purchase doubling the nation's size.

At 61, was elected to a second term as President.

At 65, retired to Monticello .

At 80, helped President Monroe shape the Monroe Doctrine.

At 81, almost single-handedly created the University of Virginia and served as its first president.

At 83, died on the 50th anniversary of the Signing of the Declaration of Independence along with John Adams

Thomas Jefferson knew because he himself studied the previous failed attempts at government. He understood actual history, the nature of God, his laws and the nature of man. That happens to be way more than what most understand today. Jefferson really knew his stuff.

Thursday, September 15, 2011

Tuesday, September 13, 2011

The Four Rules to Becoming Your Own Banker (Infinite Banking Concept)

Becoming Your Own Banker is a financial strategy that empowers individuals, business owners, and corporations to profit the same way banks do. This is accomplished by having access to your capital on your terms, not the banks. It also provides a way to grow your money tax-free without risk of stock market loss. And unlike a 401k/IRA government retirement account, the money is held in a private contract that can provide tax-free income at retirement.

If you follow these rules, you will eliminate your local bank and finance company from your life forever.

Rule #1: Think long range like a forester.

It's been said the best time to plant a tree was twenty years ago. So twenty years ago would have been the best time to think about planting. If you have the discipline to save money, now is the time to start your policy, not 20 years from now. Unlike a forester though, with the Infinite Banking Concept you can begin utilizing the benefits of your savings from the beginning because the IBC strategy provides liquidity while you are growing your savings. You can use the money for any purpose and without any conditions.

The money you save should last a lifetime. If you have a short term need for your money, the Infinite Banking Concept is not right for you.

Rule #2: Don’t be afraid to capitalize.

A customized dividend paying whole life policy is the best place in the world to have capital. It is insured from loss by the insurance company and has tax-favored status under the Internal Revenue Code.

Each year, the policyholder is contractually guaranteed to have an increase in cash value EVEN IF YOU USE THE MONEY FOR OTHER PURPOSES.

The #1 lesson to learn in building wealth is never lose capital. Every time you lose capital, you miss out on future opportunities. Don't be afraid to capitalize your policy.

Rule #3 Don’t steal from yourself.

You would never take a loan from bank and not pay the bank, right? The same rule applies to a loan you take from yourself. Let's take it one step further. If you knew you were going to re-capture all the interest you were charging yourself, how much interest would you pay yourself?

All that extra interest creates more capital in your policy. The more capital you create, the more opportunities you will have to invest.

Rule #4 Don’t do business with banks.

There are likely more banks than coffee shops on the main street of the town you live in and the tallest buildings are usually bank buildings. Doesn't that seem a bit odd to you? This is because the banking business is the most profitable business in the world. Businesses come and go, but the business of banking is eternal.

Only when you control your banking function will you be able to protect and grow your wealth safely and predictably through recessions and even depressions. If you do nothing, you will continue chase risk, jeopardize your financial future, and give the banks the interest on your money you would have otherwise earned for yourself and family.

Summary

My advice is simple. You can choose one of two options.

Think like a banker. Protect your assets. Pay yourself back and with interest. Become your own banker!

Or you can continue to be a pawn of your bank, finance company, and Wall Street.

The intangible value of Becoming Your Own Banker is incomprehensible. A whole life policy is a private contract with other free people and it precludes the necessity of contracting with the bank. It is your safe and predictable ticket to growing and preserving wealth now and for your next generation.

Contact me to learn more: www.IBC.guru

I can customize a policy to fit your unique situation and advise you on how to implement Infinite Banking into your life. 99% of advisors in the financial community including CPA's and Certified Financial Planners do not have the required training and expertise to explain the benefits of the Infinite Banking Concept. You want to work with an expert in this field. As an authorized advisor with the Nelson Nash Institute, I encourage you to interview me and ask questions to determine how you, your family, and even your business can benefit from this strategy.

Thank you,

John A. Montoya

If you follow these rules, you will eliminate your local bank and finance company from your life forever.

Rule #1: Think long range like a forester.

It's been said the best time to plant a tree was twenty years ago. So twenty years ago would have been the best time to think about planting. If you have the discipline to save money, now is the time to start your policy, not 20 years from now. Unlike a forester though, with the Infinite Banking Concept you can begin utilizing the benefits of your savings from the beginning because the IBC strategy provides liquidity while you are growing your savings. You can use the money for any purpose and without any conditions.

The money you save should last a lifetime. If you have a short term need for your money, the Infinite Banking Concept is not right for you.

Rule #2: Don’t be afraid to capitalize.

A customized dividend paying whole life policy is the best place in the world to have capital. It is insured from loss by the insurance company and has tax-favored status under the Internal Revenue Code.

Each year, the policyholder is contractually guaranteed to have an increase in cash value EVEN IF YOU USE THE MONEY FOR OTHER PURPOSES.

The #1 lesson to learn in building wealth is never lose capital. Every time you lose capital, you miss out on future opportunities. Don't be afraid to capitalize your policy.

Rule #3 Don’t steal from yourself.

You would never take a loan from bank and not pay the bank, right? The same rule applies to a loan you take from yourself. Let's take it one step further. If you knew you were going to re-capture all the interest you were charging yourself, how much interest would you pay yourself?

All that extra interest creates more capital in your policy. The more capital you create, the more opportunities you will have to invest.

Rule #4 Don’t do business with banks.

There are likely more banks than coffee shops on the main street of the town you live in and the tallest buildings are usually bank buildings. Doesn't that seem a bit odd to you? This is because the banking business is the most profitable business in the world. Businesses come and go, but the business of banking is eternal.

Only when you control your banking function will you be able to protect and grow your wealth safely and predictably through recessions and even depressions. If you do nothing, you will continue chase risk, jeopardize your financial future, and give the banks the interest on your money you would have otherwise earned for yourself and family.

Summary

My advice is simple. You can choose one of two options.

Think like a banker. Protect your assets. Pay yourself back and with interest. Become your own banker!

Or you can continue to be a pawn of your bank, finance company, and Wall Street.

The intangible value of Becoming Your Own Banker is incomprehensible. A whole life policy is a private contract with other free people and it precludes the necessity of contracting with the bank. It is your safe and predictable ticket to growing and preserving wealth now and for your next generation.

Contact me to learn more: www.IBC.guru

I can customize a policy to fit your unique situation and advise you on how to implement Infinite Banking into your life. 99% of advisors in the financial community including CPA's and Certified Financial Planners do not have the required training and expertise to explain the benefits of the Infinite Banking Concept. You want to work with an expert in this field. As an authorized advisor with the Nelson Nash Institute, I encourage you to interview me and ask questions to determine how you, your family, and even your business can benefit from this strategy.

Thank you,

John A. Montoya

Thursday, September 8, 2011

G. Blake Griffen Interview 9-8-2011

G. Edward Griffin interview. Listen by clicking here.

Skip to 7:00 for the beginning of the interview. Mr. Griffin is THE source for information on the Federal Reserve. I also highly recommend reading his book: The Creature From The Jekyll Island.

Most people don't understand inflation. You should. Mr. Griffin explains the Federal Reserve creates inflation and more.

Skip to 7:00 for the beginning of the interview. Mr. Griffin is THE source for information on the Federal Reserve. I also highly recommend reading his book: The Creature From The Jekyll Island.

Most people don't understand inflation. You should. Mr. Griffin explains the Federal Reserve creates inflation and more.

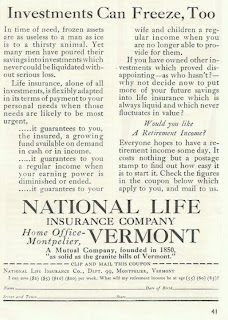

Investments Can Freeze, Too

This is well said. Thank you to Rick Bueter for finding and sharing this. This was an ad run in the 1930's!!!

Subscribe to:

Posts (Atom)