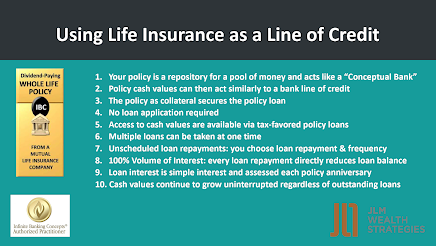

* No application process. I ask for the money and I get it. I don't have to qualify...ever!

* Instant liquidity of repayments. Every dollar I repay on my policy loan is instantly available to be borrowed again without application or qualification, as opposed to a bank loan where payments simply reduce the unpaid principal balance.

* Another huge reason for borrowing against your life insurance policy is the flexibility of the repayment plan. This is especially important if you are business owner with cash flows that fluctuate monthly. Re-pay policy loans based on your schedule, not the banks.

* Privacy. If you have kids to put through college, consider that your bank assets, and even your kid's 529 account, will account against them when qualifying for finanical aid. You can pay the retail cost of college but wouldn't you rather get a discount? Strategically placing money in life insurance contracts shields this money from prying eyes. It also helps you in retirement because policy loans used for income are tax-free and won't bump you into a higher tax bracket. Retirees with 401k distributions have to report taxable income that potentially reduces Social Security benefits. Ouch!