Let's start by getting a couple things out of the way when it comes to dividends on a participating Whole Life policy:

1. You have growing cash value (guaranteed interest and non-guaranteed dividends that become guaranteed once declared) when loans are taken.

2. One option is not necessarily better than the other. That said, someone trying to sell you a policy might try to persuade you otherwise for their own purpose (they might only work with one type of company).

3. Infinite Banking Authorized Practitioners are (or at least should have been trained to be) completely agnostic. They shouldn't favor one over the other for reasons explained below.

What follows below is a deeper dive into the world of Whole Life dividends to help further your Infinite Banking (aka IBC) knowledge.

-----

There are two types of dividends you can get in the Whole

Life world.

- Direct Recognition

Dividend

- Non-Direct Recognition

Dividend

From a marketing point of view, advisors will “sell”

non-direct as the best option because dividends are unaffected by loans.

However, this is a half-truth.

There is no free lunch which we all know to be true in

life. Same lesson applies here with direct vs non-direct. If a life

insurance is paying the same dividend regardless of whether a person requests a

loan, that means there is something else going on.

Here is the other half for the full picture on non-direct

dividends. Life insurance companies that pay a non-direct dividend pay

out lower dividends to everybody to offset the cost of borrowing from the general fund of the life insurance company for those who do take loans.

Essentially, those who do not take policy loans are subsidizing those that do.

So the question becomes would you rather have the potential for

the highest dividend you can get every year? Or would you be happy with a

lower but level dividend for all years? With a direct recognition

dividend, you have the highest potential for dividends without having to subsidize

other people who may or may not take policy loans. You still get declared dividends when loans are outstanding. They are not taken away from you because you have a loan. However, you will get a reduced portion of the dividend if a loan is taken.

Back in 2007 I emailed Nelson Nash, author and creator of

Becoming Your Own Banker (the pioneer of IBC) and he surprised me by

calling me out of the blue. He was already well into his 70’s at that

time. I wasn’t expecting an email back let alone a phone call. I had

emailed him about direct vs. non-direct because I wanted to know which was

better for my own situation before I started recommending a particular choice to my clients.

The first thing he said to me after introducing himself was to

thank me for reading his book and for helping

him to spread his message about IBC by being a professional in the industry. Then in his thick and sage Alabama accent

which I recognized as Nelson’s right away even though we’d never spoken before

(no introduction needed!), he said something I have never forgotten.

He said in that kind, old man Alabama drawl, “Now son, you’re majoring in the minors!”

What a thing to say! If he didn't already have my utmost attention, he surely had it then.

Now you have to know Nelson had a certain way of teaching fundamental

truths. If you’ve read Becoming Your Own Banker (it’s worth re-reading

from time to time), you know he uses analogies and euphemisms quite a bit to

explain important points that should not be taken for granted.

That's exactly what he did with me over the phone

at 7:53am PST while I was packing my little ones into the car for a ride to

their pre-school. It instantly hit me what he was saying and has stuck

with me ever since.

Direct vs. Non-direct ultimately doesn’t matter in the big

picture of IBC.

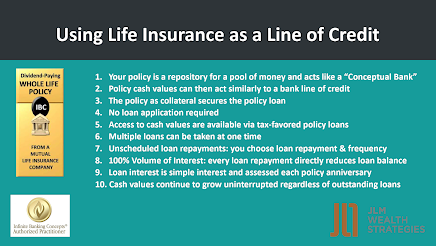

The whole point of Infinite Banking is to own and control

a system of money that you are constantly directing your flow of money into so

you can eliminate the middle man (traditional banks). The freedom of control and use of money for any purpose while enjoying all the perks of an ultra-safe and ultra-liquid

cashflow management system where you are guaranteed to have uninterrupted (tax-free

even!) growth and access for life is the main point.

Banks become super wealthy because they rob of us this freedom by fooling us into believing we need them. We don't! They are the middle man in the money game that seeks to control the flow of your money for their profit.

He went on to explain to me that all I need to do is have “a

good administrator (life insurance company) to handle administration and paperwork.” The

dividends will be there as they have been for 150+ years and counting.

So to return to the discussion of direct vs non-direction

and understanding the difference… while it may be good to know (especially if

the only thing learned is a half-truth), it ultimately isn’t the reason why you

choose to go with one life insurance company or another.

Getting back to Nelson’s bigger picture, if a person is

really doing IBC correctly, they are going to have multiple policies (with

different companies – direct and non-direct dividends) over time which will

eventually incorporate their total cashflow.

It’s not an either/or proposition on which is better because you are going to receive dividends whether you

have a loan outstanding or not. It essentially comes down to:

Are you

okay subsidizing yourself and others who take loans (non-direct) and therefore

take a reduced dividend for all years or obtain the highest potential dividend

based on your own loan borrowing and repayment schedule…

But as Nelson reminded me years ago:

don’t lose sight of the bigger picture ("don’t major in the minors!").

Nelson instructed everyone to do 4 things to achieve

Becoming Your Own Banker:

- Think long-term.

- Don’t be afraid to

capitalize (open a policy and max-fund a properly designed Whole Life

policy).

- Don’t steal the peas

(repay your loans at a “higher interest rate” – another euphemism meaning

re-capitalize quickly so have capital for your next opportunity).

- Stop working with the

middle man (i.e. traditional banks).

If you have more questions you'd like answered about Infinite Banking, let me know! You can find me at www.IBC.guru.

Thank you,

John A. Montoya

JLM Wealth Strategies, Inc.

Bank On Yourself® Authorized

Advisor

IBC® Authorized Practitioner

CA Life#0C42222