I get a lot of questions about Infinite Banking. For this post I'm sharing a recent email I responded to from a potential client. Names have been removed.

Hi ----,

Thank you for your questions. Definitely a lot of

craziness going on. The life insurance industry is not immune

either. Some age groups are being excluded (over 70) temporarily,

scheduling exams is a very tall order, and doctors offices seem to be

overwhelmed so getting medical records to underwriters is super slow.

It doesn’t surprise me your traditional financial advisor is

skeptical.

They’ve been trained and conditioned to think, recommend, and

implement Wall Street based portfolio plans. Life insurance is mostly an

afterthought to traditional advisors because they operate on a Wall Street

revenue model.

Sadly, Infinite Banking is unknown to the majority of life

agents because the life insurance industry doesn't teach this strategy. Life insurance industry trains agents to sell policies for maximum death benefit

protection. So it’s the proverbial “can’t see the forest thru the trees” for traditional Wall Street advisors and life only agents which is why working with an

authorized IBC advisor is the best way to learn

and implement the strategy. Authorized being the key word there. (

The Nelson Nash Institute is where you can go to confirm your advisors status.)

Infinite Banking isn’t even about the death benefit.

It’s not even about having a Whole Life policy. The Whole Life policy is

just the best vehicle for the strategy. If it wasn’t we’d be using and

recommending bank line of credits, mutual funds, and 401ks/IRAs instead.

But none of those options give us control over our money safely and efficiently

(…and even tax-free) all in one place. IBC is about freedom over our

money—taking control back from banks and Wall Street. Traditional

advisors (Banks/Wall Street) want that control outsourced to them so IBC is

naturally a paradigm shift from mainstream financial planning. Traditional

advisors also don’t practice IBC so seeking advice from them is like going to a

foot doctor for a chest pain.

I’d be happy to show you options for retirement income using

the strategy. We can do a virtual appointment and I’ll record it so you

can share with your wife. Schedule here:

www.IBC.guru

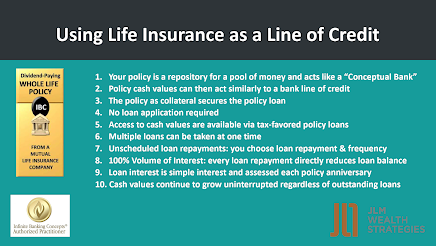

Regarding loans, there’s more to it than the loan rate...

Loans are simple interest and calculated at the end of your

policy year. Currently, most carriers loan rates are 5% which is fixed

for 1 year at a time. Historically, policy loan rates have been between

5-7% because the borrowing rate is based upon a cost of money index used for

the largest AAA rated companies in the world. Essentially, policyowners

get to borrow at rates available to blue chip corporations. The 5% rate

hasn’t budged in 13 years and when they have adjusted up or down, it’s a slow

movement. Life insurance companies tie the borrowing rate to this type of

corporate money index because it also happens to be where 90% of their

investment portfolio resides.

So when I request a loan from my policy, they are more or

less approximating the same interest return on their investments as they will

now eventually receive on the policy loan I take. Also, keep in mind all

the policy loan interest is revenue for the life insurance company. Since

these companies are mutual based (owned by policyowners), this revenue from

policy loan interest ends up as part of the surplus profit of the life

insurance company and what happens to surplus profit? It gets returned to

policyowners (you and me, not shareholders on Wall Street like with stock based

life insurance companies) as a dividend compounding our cash value and death

benefit further.

FYI, there are policies that offer a fixed rate policy loan

but fixed rates are generally 7.5 to 8%. My oldest IBC policies are fixed

at 7.45%. I rarely use the cash values in these policies because my other

policies are at 5%. My family (me, my wife and 3 kids) have a total of 11

policies so we have a pretty substantial pool of money that’s always growing

and under our control with access at various rates. I tell people if they

are really practicing IBC properly, they will have more than 1 IBC designed

Whole Life policy and when that happens you can diversify with policies that

have slightly different options depending on what you’d like, including

different borrowing rate options.

Another key aspect with policy loans is that because

interest isn’t calculated until the end of the policy year, each loan repayment

I make goes towards reducing the loan balance dollar for dollar i.e. 100%

volume interest. Super consumer friendly.

This doesn’t happen with a bank loan. Banks

collect a portion of interest from your payment first, then the difference is

applied to the outstanding balance. This effectively delays debt

repayment… and don’t forget, all banks are also charging compounding interest

while they delay the debt repayment. Think of a mortgage payment.

How much of a mortgage payment is interest first? The majority of

it. Car loans, credit cards… same story. Not with a life insurance

policy loan. Every cent of the loan re-payment directly reduces the policy loan

balance. Policyowners come first.

So nominally you might be charged 5% but your effective

interest is lower because you reduce the loan balance dollar for dollar. Your effective loan rate (percentage of %)is actually lower

You also determine the loan repayment schedule.

You are the banker.

Meanwhile the underlying asset (the cash values and

eventually the death benefit) securing each policy loan are compounding in

value while the money is used elsewhere for any purpose: pay down debt,

invest in other assets, pay taxes, or even for retirement. 😊

Nothing like it anywhere else.

With regards to your concern about hyperinflation

There you will find the book How Privatized Banking Really Works by Robert Murphy,

PhD and Carlos Lara. It's free to download. Just click on the image. On page 340 of the book, they will answer your

question about what to do with IBC whole life policies in event of

hyperinflation. The entire book is phenomenal. You have to get to

the end of the book to get to their take on IBC but it’s well worth it. I

have this book available on my website for free to download but I’m including

it here in this email. The arguments are all laid out. There are

other great books on my website with links to purchase, too. The Pirates

of Manhattan is another great book that comes to mind which was thoroughly

enlightening, too. The amount of documentation supporting that book in

particular against banks and Wall Street is overwhelming and cannot be refuted.

Hope this email helps answer questions you have about

IBC. Let’s keep in the conversation going. The more you know, the

easier it is to make decisions you and your family can benefit from.

Thank you,

John