Guaranteed Vs. Non-Guaranteed: Understanding Whole Life Values

I'm to going to discuss the difference between guaranteed vs non-guaranteed values within a Whole Life policy, why having a foundation of guarantees is arguably the most important detail in setting up a “family banking system”, and revisit what distinguishes a contract from an investment.

Guaranteed vs Non Guaranteed

Guaranteed Values: this is the year by year performance guarantee in detail out to endowment (typically age 121). It’s based on math and actuarial science. Life insurance companies provide a blueprint based on worst case projections should a dividend never be paid during your lifetime. Something to keep in mind: All the life insurance companies we use for IBC have been around for at least 100 years, are A rated, and most importantly to me, they have never missed paying a dividend… ever! So the guaranteed values reflect a scenario of no dividends for the life of the contract yet it’s a scenario that’s failed to material even for one year. Let that sink in for a moment.

You essentially have a fool proof system that is guaranteed to increase in value without any luck, skill, or guesswork during your lifetime. No other place for money exists with the same level of guarantees that what you want to have happen, will happen, even if you’re not around to see it. The last part of course speaks to the tax-free death benefit bestowed on your beneficiaries when you graduate to the next level.

Non-guaranteed values: Take the guaranteed values and now add non-guaranteed dividends from the surplus profit of a mutual based life insurance company. That’s it. Life insurance companies are highly profitable but legally they cannot guarantee the dividends they will pay out next year or, 5 years from now, or ever. By law, they have to project future values based on the current dividend scale. They can’t assume interest rates will increase in the future and project higher dividends. So the non-guaranteed projections are IMO conservative estimates of future performance.

The most important detail in setting up a “family banking system”

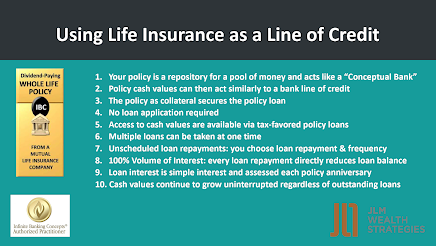

For banking purposes, this is a one of a kind “turn-key”, ready made financial system that is created with the purchase of a Whole Life policy. IBC practitioners who have been around will recall that Nelson Nash was fond of saying: “Every time a person buys a life insurance policy they are starting a business from scratch.” That business of course is a private family banking business between you and the life insurance company at what Nelson would call the “you and me” level.

Of course, you do have to read between the lines of the contract to fully grasp the idea of Infinite Banking. This is where the majority of people who first stubble upon IBC get stuck in the weeds. They see a life insurance policy and get stuck.

I once heard Nelson say that calling this financial system a Whole Life insurance policy is one of the worst things the life insurance industry has ever done. Right from the start, the life insurance industry provided a label that continues to confuse the masses to this day. The smallest minds see life insurance policy and that’s all it will ever will be.

Those of you who take the time to read Nelson’s book “Becoming Your Own Banker”, listen to our 30+ episodes now all related to Infinite Banking, and speak to an Authorized IBC practitioner, will realize what Nelson said from the beginning. The Infinite Banking Concept is an idea. It is not about life insurance. It’s about controlling the banking function at the you and me level to root out rent seeking traditional banking system that will have you believing their “lies, lies, lies”.

And what is the biggest lie of all?

That you need Traditional banks to finance all the major capital expenditures in your lifetime. Simply not true but this of course is not what we are taught. 12 years of government schooling, 100’s of higher education degrees, and none of it teaches you the history of money and the importance of banking?

Why? It’s about control. Control the flow of money, create debt, and traditional banks have a client for life. It’s parasitic relationship that need not to exist.

To bring it back to Guaranteed Values, a whole life contract provides the legal framework for a financial entity that is guaranteed to increase in value every year of your life. The contract also provides you with guaranteed access to the cash values. You can never be turned away.

Imagine the peace of mind knowing you have posited your labor into a system protected by contract law, is considered an asset available for your use with no questions asked, and it is only solely by you. Nothing else in the financial world like it. No 401k/IRA or asset class can replicate the guarantees of a Whole Life contract.

Contracts vs. Investments

We'll refer to this as "Contractual" Wealth vs “Statement” wealth.

Statement wealth is when a client gives their money to an institution or organization in the hopes that they can get their money to grow. In this arrangement, the giver of the money assumes all the risk for the growth of the money. The organization sends a statement 1-4 times per year, telling them how they are doing at that time.

Contractual wealth is when a client gives money to someone else as part of a contract. The recipient of the money assumes the risk.

Reminders:

IBC working is NOT predicated on dividend performance and chasing rate of return like you would with an investment. It is a financial system, period.