I've been including some information in my monthly newsletter in recent months about Bitcoin to help introduce this new burgeoning asset class to wider audience. This month I'd like to go a step further to help those who maybe still aren't ready to exchange some of their fiat dollars to own Bitcoin for the first time. Or if you already own Bitcoin, perhaps this will be an introduction on how to stack additional "sats" (fractions of bitcoin called satososhi's) without even thinking about it and with no money out of pocket.

First, it's important to understand what is Bitcoin so I'm including this fantastic Audio Glossary on Bitcoin by Natalie Brunell. It's only 8 minutes and she covers a lot of ground in a short amount of time.

Next I'd like to help you develop your WHY for owning even a small amount makes absolute sense. I'll do that by sharing my why.

I bought my first bitcoin for $356 in 2016 and though I've purchased more since initially I bought it because I loved the idea of an alternative peer to peer financial system that could operate outside of government influence (manipulation/corruption) and without 3rd party (banks and Wall Street) permission. Does this sound familiar to Infinite Bankers and Austrian economists?

And it offered one additional, very unique characteristic compared to fiat money (government controlled dollars): a fixed and predetermined supply of 21 million Bitcoins ever. Finally, an honest and sound money system with no counterparty risk that actually works regardless of how you or I or any government feels about it. Anyone with access to the internet can own a piece of this pristine digital asset.

Compare this to centrally controlled fiat currencies which requires the creation of debt to issue new units of fiat. More buying units equals less purchasing power. Think of this next time you go to the grocery store and try to recall, depending on your age, what a gallon of milk cost last year versus 20 or even 40 years ago.

This is the government stealing your labor through inflation and it is centrally planned to work this way. No conspiracy there except that "the powers that be" would you really prefer you not understand their capability to manipulate the money for as long as conceivably possible.

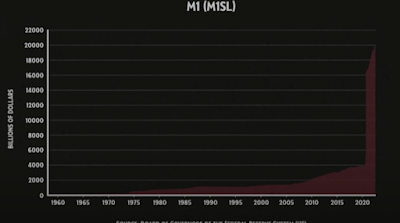

|

| Since January 2020 the US has printed nearly 80% of all US dollars in existence. $4.0192 Trillion at the start of 2020, October 2021 $20.0831 Trillion |

The existing monetary system is the root cause for a century of endless wars, expanding government, and neverending political disfunction. Until Bitcoin, there was no free market alternative that could provide a solution to preserve the value of our labor.

Think about what money is? It's a medium of exchange. We exchange our time and energy (work/labor) for money. But a lifetime of savings can be wiped out with a push of button because we are forced through Legal Tender laws to use politically controlled money that is purposely debased for the benefit of the entities in control of the money (government and banks).

This debasement forfeits our labor ie savings gradually over time. In a lot of countries around the world though, it's gradually and then suddenly. Think Zimbabwe, Venezuela, Cuba, Turkey... Argentina, Mexico, Germany in the 1920's.

If you think a default on money can't and won't happen in the United States, here is your wake up call. It happen in August of 1971. That's when President Nixon "temporarily" closed the international exchange window for countries to redeem dollars for gold. Simply put, there was an international run on the dollar because countries realized the United States government had more liabilities (created by the Vietnam war/new social welfare benefit programs) than gold to back to the supply of newly created money so they called in their gold reserves the US government had been safeguarding since World War 2. The "Nixon Shock", still in effect to this day, was effectively a dollar default and it made all curriencies pegged to the dollar with the dollar effectively pegged to the "faith and credit" of the United States government. For 50+ years we've been operating in this fiat world and generations of us have never experienced anything else. It's truly remarkable we've made it this far but there is a reckoning and we are now seeing it with highest inflations numbers in 4 decades.

For example, government manipulated Consumer Price Index reported recently 7% inflation year over year. To rephrase this, the government stole 7% of the value of dollar demoninated assets you own. And the inflation number was probably twice that.

How does any of this make you feel? Any type of theft should absolutely upset all of us but first we have to be aware of how it happens, who's behind it, and ultimately there has to be a working solution.

As an Infinite Banking policy holder (12 policies and counting) and licensed practitioner, the idealism behind Bitcoin immediately resonated back in 2016. Bitcoin IS freedom and like Infinite Banking, it provides me the ability to take ownership, responsibility, and accountability for my financial life.

So I bought Bitcoin initially on idealism. And I set up monthly drafts of $50 and then $100 month to see what would happen and I more or less forgot about it for a couple of years. I'll admit I didn't fully understand how Bitcoin worked. I mean, how exactly is the network secured? How does Proof of Work technology compare to Proof of Stake? Why can't governments ban it or shut it down?

Though my faith has been rewarded in terms of long-term value since 2016, it wasn't until 2021 that I finally started reading about the technology behind Bitcoin with books like The Bullish Case For Bitcoin and December's newsletter book recommendation The Fiat Standard that I really found my conviction for Bitcoin. Amazing what a bit of actual research will do.

Now I know in talking to many of you, there is concern about the price volatility of Bitcoin or regret that you didn't buy it a few years back. Here's what I say to those people. You have to stop thinking of Bitcoin like an investment. This is very similar to how people confuse Infinite Banking Whole Life policies as an investment. Neither are truly investments. Reminder, IBC Whole Life is based on a contract and without extrapolating here, it is like a Swiss Army Knife in all benefits and functionality it provides.

Bitcoin is a technology. Bitcoin is a protocol. Bitcoin is anti-Fiat. Bitcoin is a life raft.

After digging deeper into my research, this is my belief. I believe Bitcoin ranks up there as one of the most important inventions in history alongside the printing press, the internet, and electricity.

At the most basic level, I think it's vital to understand Bitcoin as a unit of account. 21 million Bitcoins finite. That's it. Never any more than 21 million and each Bitcoin can be divided into fractions as mentioned above. This is important for Bitcoin to operate as a form of money. Bitcoin is more than money, but if people are going to adopt it as money, it first needs be measurable as a unit of account.

In comparison, how many US dollars is there in circulation? Nobody truly knows but with Bitcoin you absolutely do know. It is 100% transparent at all times and 100% verifiable. Can't say that about any government controlled fiat currency.

Now let's tackle store of value. If we know there will only be 21 million Bitcoin, we know if we began to hold Bitcoin instead of fiat currency, over the long term horizon Bitcoin will maintain its value better than an infinite supply of fiat currencies. This preserves our labor instead of being forced to spend our money (or take on risky investments) to stay ahead of the devaluation of our dollar denominated fiat.

Bitcoin is able to maintain a store of value because it has the most transparent ledger ever created. Its transparency is also what makes it impossible to shut down, ban, or manipulate. Unlike fiat, Bitcoin is immutable. No government or large entity can change it. There's a Bitcoin saying which is one of my favorites: "You can't change Bitcoin. Bitcoin changes you."

This might be difficult to understand right now, but keep this in mind. Bitcoin is simultaneously everywhere and nowhere at the same time. All the time. This is because Bitcoin is a ledger of account that tracks every single Bitcoin in existence through its code which every node and miner that operates the bitcoin software possesses. Nodes/Miners work together to confirm the existence of bitcoin and every transaction is then added to a blockchain ledger in a process that happens on average every 10 minutes forever.

You can travel anywhere in the world and take your Bitcoin with you. It truly is a remarkable feat.

I say this after being reminded during my trip to Costa Rica when I was asked upon leaving and returning if I had more than $10,000 cash or property in my possession. Of course not. I'm not going to carry on me that match cash to declare in order for it to be seized, but what about my Bitcoin? I find it fascinating that Bitcoin is simultaneously everywhere and nowhere at the same time. All the time. It exists on a public blockchain so it goes where I go but only I have the private keys (cryptographic permission) to unlock control of the Bitcoin I own regardless of where I am in the world.

Because the network is so effectively decentralized (no center point of failure to shut down) it remains the most secure network that has ever existed. No other network competes with Bitcoin on security, reliability, and predictability.

Think about this from a government perspective who might choose to be hostile (China has tried to ban it maybe 17 times now?) towards Bitcoin rather than embrace it (El Salvador). There is no Bitcoin company, no CEO, no board of directors, no on/off kill switch that any government can flip. That's why Bitcoin exists everywhere and nowhere at the same time. It is quite literally the internet of money.

Think of why the internet was created. It was created as a messaging system in the event of a nuclear holocaust. We no longer think of the internet in terms of the TCP/IP protocol which is the agreed upon language of the internet but the purpose of the internet is to communicate effectively and efficiently through the worst man-created nightmare we could imagine. The internet cannot be shutdown. The same with Bitcoin because it operates on the rails provided by the TCP/IP protocol which connects to nearly everything these days.

So Bitcoin is a technology that secures allows each individual with access to the internet to send and receive messages through the internet with the use of electricity. What type of technology? It is software that provides a base level messaging protocol via a peer to peer network (through the use of nodes and mining equipment using a copy of the Bitcoin software) to communicate a message ("is this Bitcoin transaction good or bad?") from one end of the earth to the other at the speed of light. The value of the message is inconsequential. In fact for the first couple of years of its existance Bitcoin had no value until 10,000 Bitcoins were famously used to buy 2 pizzas giving a single Bitcoin its first price in fiat terms.

What makes the Bitcoin network secure? The very short answer: Proof of Work. Please read the recommended books for a detailed answer but I'll add this.: The current government fiat monetary system is based on something like Proof of Stake technology. How well does this Proof of Stake technology work for you and I? Social inequality grows unabated. Ironically, so does the federal government.

The Keysian solution is always to "print" more money... and I think we're all starting to understand what's really happening.

Check the annual inflation figures and think about how the federal government has expanded beyond anything the Founding Fathers of this country ever intended or possibly could of imagined. Money is truly the most powerful weapon against freedom that exists but it can also be the solution.

This is why the Bitcoin Adoption Rate exceeds even the adoption rate of the internet. Think about that for a moment. As great and transforming as the internet has been in so many countless ways in our life, more people around the world have adopted Bitcoin at a faster pace than use of the internet!

Why? We are spoiled here in the United States because we currently hold status as the world's reserve currency. Every other currency is pegged to our dollar but for how much longer? As Voltaire said: Paper money eventually returns to its intrinsic value - zero.

In other counties where weaker fiat currencies exist, the adoption of Bitcoin is the highest. This makes sense. Bitcoin is a life raft for these people who are experiencing debilitating inflation that make the value of their money worthless at rate Americans can't possibly fathom. We are truly blessed here in comparison but we have to realize that for us, it's just a slower bloodletting.

As we learned from Nelson Nash and Infinite Banking, to be successful long-term we must think long-term. And long-term should be your horizon for holding Bitcoin. Anything less than 10 years and I would argue you are thinking in terms of price speculation and miscalculating the true value of Bitcoin. It is a life raft. It is the insurance against the evitable failure of government created fiat.

Some of you may be thinking: If Bitcoin is such an amazing technological invention that preserves the value of our capital long-term, then how does Infinite Banking still make sense? Great question and I'll be answering it next month.

For now though, if you don't own any Bitcoin, I would like you to "get off of zero". Here's the easiest way you can start "stacking sats" with no money out of pocket.

GET OFF ZERO!

If you are like most people, you have a credit card and that credit likely has a rewards program that gives you points that you can redeem towards something. That's all good and dandy but here's my truth now. I don't want reward points I can redeem on Amazon or travel points I can redeem on Southwest Airlines or points I can redeem to offset the price of my Costco membership.

I want reward points that automatically pay me in Bitcoin that will be worth more to me and my family in future years as all fiat currencies continue to debase like they are created to do.

Since September I've made the Blockfi credit card my primary credit card earning bitcoin every single month since. It is one of the easiest ways to "stack sats" I have found because all I have to do is remember to pay with BlockFi credit card.

If you use this link to register for your own BlockFi credit card, the current offer is we'll both receive $40 of Bitcoin. Pretty nice!

No annual fees and no international charges when you travel abroad. I used it everywhere I went in Costa Rica.

Also, be sure to register your card with Visa to be notified each time your credit card is used. I do this with all my credit cards for security purposes. I like to get text messages to my phone/Apple Watch each time there's a transaction. The BlockFi card doesn't have this feature directly but it can be set up thru Visa using this link: https://purchasealerts.visa.com/vca-web/login

Thank you for reading this far. I hope you are now willing to take the Bitcoin plunge with me. If you have questions for me regarding Bitcoin, please don't hesitate to reach out to me here: www.IBC.guru

Dollar cost averaging into Bitcoin is a topic I'll be covering in the near future and I'll be sharing the platform I use. If you want the answer sooner, just reach out. And yes, I'll be covering how to use IBC and Bitcoin together so stay tuned.

Thank you,

John Montoya

No comments:

Post a Comment