IBC Mailbag: "John, I have a policy premium due and I'm wondering should I pay the total annual premium as scheduled or use the excess premium for the PUA rider to instead repay the loan on the policy? Please advise."

Here's a fork in the road for IBC policyowners eventually arrive at whether they have one or multiple IBC policies. While there's no wrong answer here, I think creating a list of priorities helps answer the question best for your situation. Here's my take on this IBC dilemma.

First Priority: Premium Contributions

My rule of thumb has always been to contribute the premium (Base and Paid Up Additions) first. Here's why.

First and foremost, the ability to contribute premium is closed ended meaning there is a finite time to make these contributions. (Note: base premium contributions - AKA the minimum premium due - must be made each year unless exercising a 12 month "premium offset" option. There is no carry-over or "catch-up" provision for the base premium. Paid Up Addition's or PUA's are optional excess premiums that may have a limited carry-over provision depending on the life insurance company. Only a few life insurance companies offer a carry-over provision from the previous years unused PUA's.)

Also, the sooner one makes a premium payment, the better the policy is going to perform in all facets. Keep in mind that once money goes into a Whole Life policy as premium, it is guaranteed to grow from that point on.

And the benefits to making premium payments go well beyond the obvious: more access cash values, more death benefit protection.

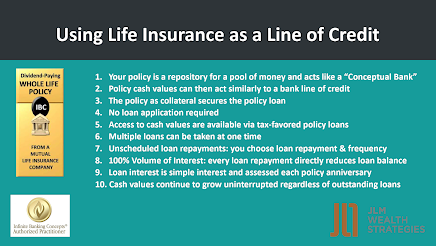

Where else can you save money and then use that money elsewhere without interrupting the compounding growth? Infinite Banking Whole Life policies are a financial unicorn!

If an IBC policy owner prioritizes repaying a loan before contributing premium, they are going to interrupt the compounding effect of future cash values. Money can only compound if it's first saved and considering a Whole Life contract will be held for the entirety of one's life, the lost opportunity cost of compounding cash values and future death benefit could be absolutely huge.

Bill Lenderman, the late IBC practitioner and mentor to many current IBC professionals summed it up best: "You'll never be in a worse position by having access to cash." ...so pay those premiums for as long as you can!

Second Priority: Repaying Policy Loans

Loans on the otherhand are open-ended and unscheduled. I've grown fond of saying over the years: "You can repay a policy loan in 2 month, 10 years, or never at all (if using loans for income)."

Policy loans, unlike bank loans, allow you to manage your cash flow to determine the best use of your cash flow.

Here's another reason why you will want to prioritise repaying loans second.

I remember Nelson Nash talking about unexpected windfalls. This windfall could be the result of an inheritance from a family member. A windfall could also come from a work place bonus, or the sale of an investment. The point is windfalls do happen, especially when you advance to using IBC policies loans to invest in real estate and business ventures.

After receiving the windfall, then the question becomes: where do you park this windfall?

If you have policy loans that are outstanding, you now have the perfect place to warehouse that money without necessarily having to start a new IBC policy.

Last reason why you should prioritise repaying policy loans second and it's simple, yet crucial.

Before you ever take a policy loan, you should have a plan to repay that loan. As Nelson would say: "Be an honest banker."

For answers to more questions like these, please contact me at www.IBC.guru

Best,

John Montoya